working capital funding strategies

Funding Opportunity Announcement FOA 1202022 0930 AM ET. Venture capitalists invested more than 10 billion in 1997 but only 6 or 600 million.

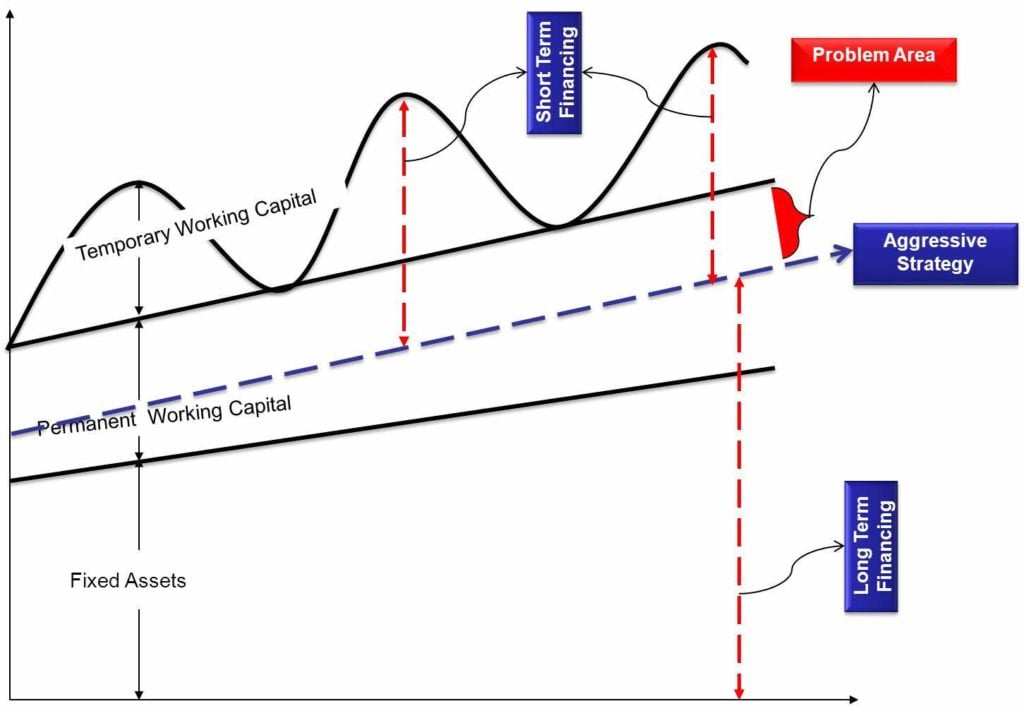

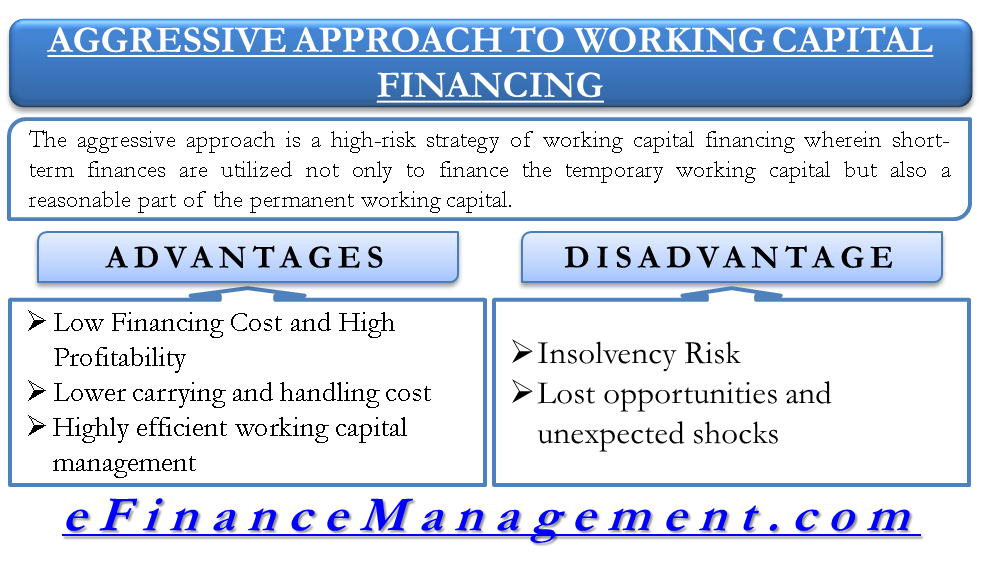

Aggressive Approach To Working Capital Financing Management Efm

Small business term loans.

. Economic Development Administration has published the FY22 Build to Scale B2S Program Notice of Funding Opportunity making 45 million in federal funds available to build regional economies through scalable startups. Its your numbers and exit strategies that must make sense in order for us to provide financing. Were a direct lender with our own internal credit committee.

Evaluate Your Short- And Long-Term Needs. Working capital loans tend to be short-term loans of 30 days to 1 year. My loan officer Bill Koder was amazing to deal with.

Therefore a business tries to shorten the working capital cycles to improve the short-term liquidity condition. In 2006 he co-founded the Legal Risk Strategies Finance business at Credit Suisse which was the first institutional commercial litigation finance business of its kind and which was spun off the banks platform as. Private capital investment can involve a broad range of different active management strategies encompassing equity and debt investment into small new and innovative businesses through to unlisted family businesses and buyouts of large listed corporations.

We provide faster funding with terms between 6 and 12 months. We look forward to funding your real estate success. Capital on Tap has secured a 200m funding facility with JP Morgan and Triple Point to support UK small businesses.

I was very surprised to put it mildly when the funding offer came in so generous at 1 million dollars for my small. Pathlight Capital is a private credit investment manager dedicated to meeting the needs of companies that operate across a broad range of industries by providing asset-based loans secured on a first or second lien basis against tangible and intangible assets. This creates a serious challenge for companies that require cash to remain competitive maintain financial flexibility and pursue potential growth.

The shorter the working capital cycle the faster the company can free up its cash stuck in working capital. Working capital financing is a common practice for businesses with an inconsistent cash flow. We use legal strategies to cut payments.

Here you will learn everything you need to know about capital campaigns. This capital does not even fetch any return. The program continues to further technology-based economic development.

This means you can receive the capital you need in as little as 5 business days. We manage hundreds of millions of dollars of litigation funding capital. Welcome to Value Capital Funding.

OR CALL 800 473-6051. This guide has been updated for 2022 so youre getting our latest strategies in a post-COVID world. ARPA-E desires input from a broad range of.

Whether an owner should self-finance depends on how small the business is. Early in the RD cycle and not integration strategies for existing technologies. Strategies and tools that you need to pursue your lofty personal and financial goals.

Supported by the private. Working Capital Financing is when a business borrows money to cover day-to-day operations and payroll rather than purchasing equipment or investment. The Deloitte working capital series Strategies for optimizing your accounts receivable Strategies for optimizing your accounts payable.

If a small business has the potential to expand quickly the owner has. LENR may be an ideal form of nuclear energy with potentially low capital cost high specific power and energy and little-to-no radioactive byproducts. Join 325000 professionals and receive proven strategies for growing your business in your inbox.

Deerpath approaches each investment as an opportunity to establish long term relationships with private equity sponsors management teams and entrepreneurs. Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance. For businesses tired of paying Merchant Cash Advance rates and that want MONTHLY repayments rather than cash flow crushing daily or weekly repayments.

Provides creative financing solutions to allow management teams to access. We leverage our. The business uses this money for.

Contrary to popular perception venture capital plays only a minor role in funding basic innovation. You can use a capital campaign to renovate or build new facilities fund special projects requiring capital investment build capacity and increase endowment. A primary reason why small businesses fail is a lack of funding or working capitalIn most instances a business owner is intimately aware of how much money is needed to keep.

Offering good credit applicants from 25k 200k with Monthly Payments up to a 5-Year Term. Such loans typically vary from 5000 to 100000 for small businesses. Testimonials This has been a very exciting time for us.

We are an out-of-the box direct lender with creative ideas to get you the funding you need when you need it. Three Working Capital Financing Strategies. A companys capital funding consists of both debt bonds and equity stock.

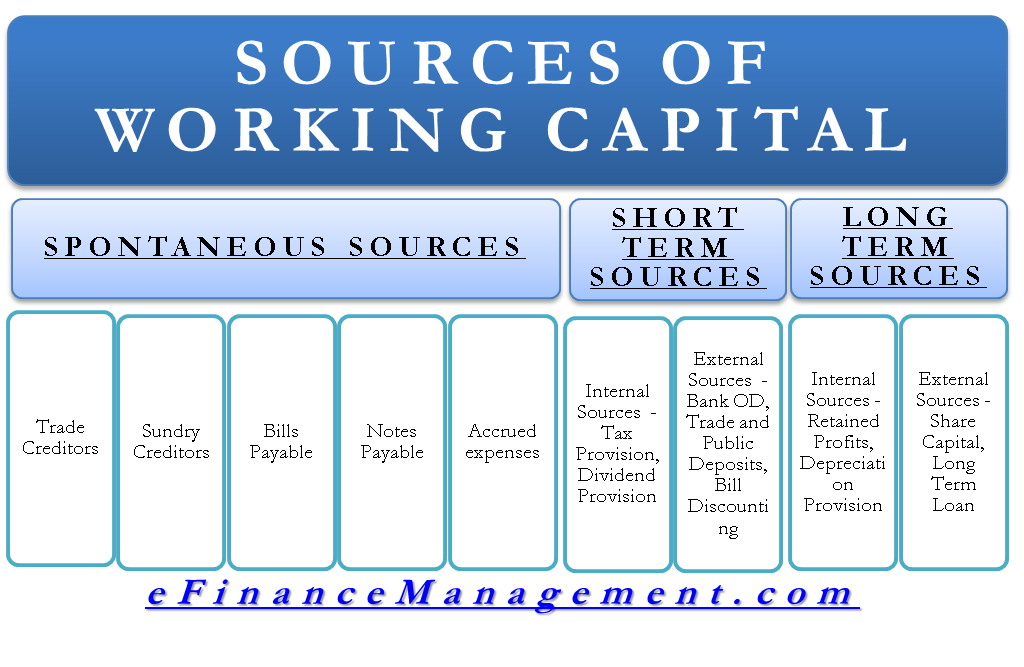

Working Capital Funding Sources. Funding a brighter future May 2022. We can finance and support cases of any size.

Both debt and equity funding remain difficult to access. US Chamber of Commerce. The funding will help small businesses access credit at a.

FISCAL YEAR 2022 BUILD TO SCALE B2S PROGRAM. Welcome to US Business Funding Solutions. Deerpath Capital Management LP is a leading provider of customized cash-flow based senior debt financing to lower-middle market companies across diverse industries.

Capital funding is the money that lenders and equity holders provide to a business. Our Working Capital Loan makes sure your business has the tools and equipment needed to generate sustain and grow revenue. We would like to show you a description here but the site wont allow us.

Too long working capital cycle blocks the capital in the operational cycle. Shore Funding gives you the opportunity to find the best funding options in the nation. I had a wonderful experience working with Cogo Capital.

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Spontaneous Sources Of Working Capital Finance

Working Capital Estimation Operating Cycle Method Learn Accounting Accounting And Finance Accounting Education

Aggressive Approach To Working Capital Financing Management Efm

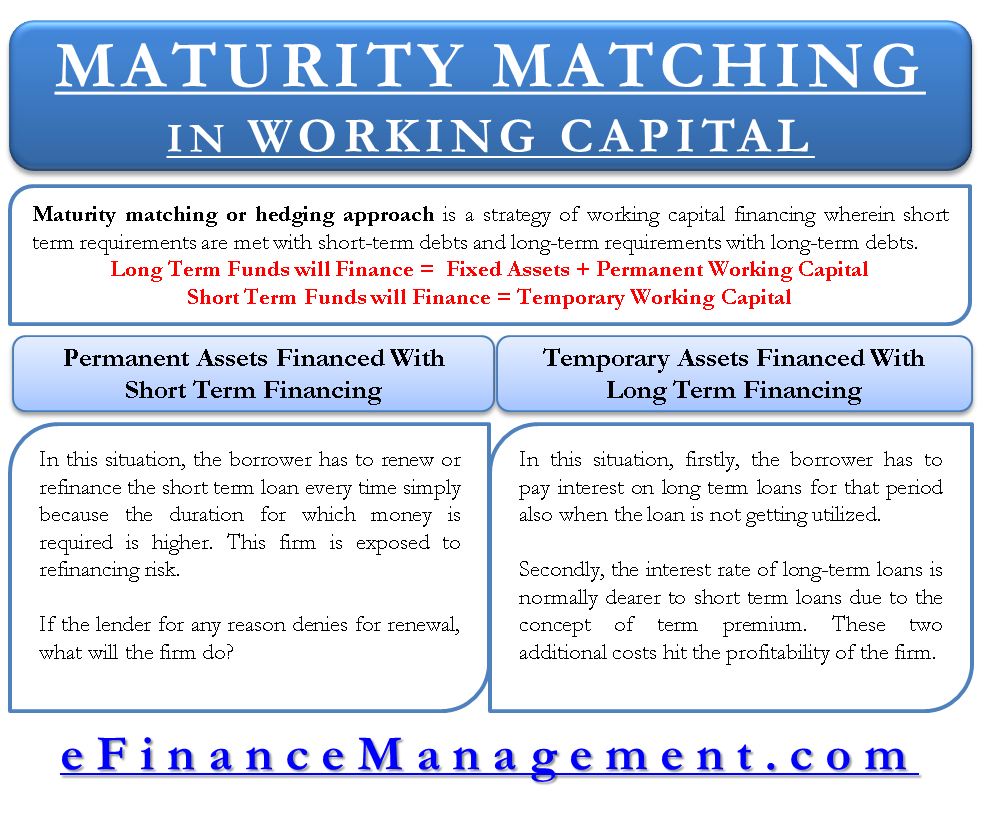

Maturity Matching Or Hedging Approach Rationale Pros Cons Example

Working Capital Cycle Efinancemanagement

Growth Equity Primer Expansion Capital Investment Strategy

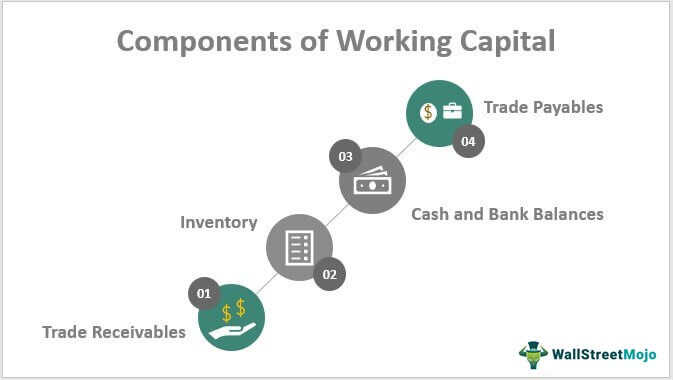

Components Of Working Capital Top 4 Detailed Explained

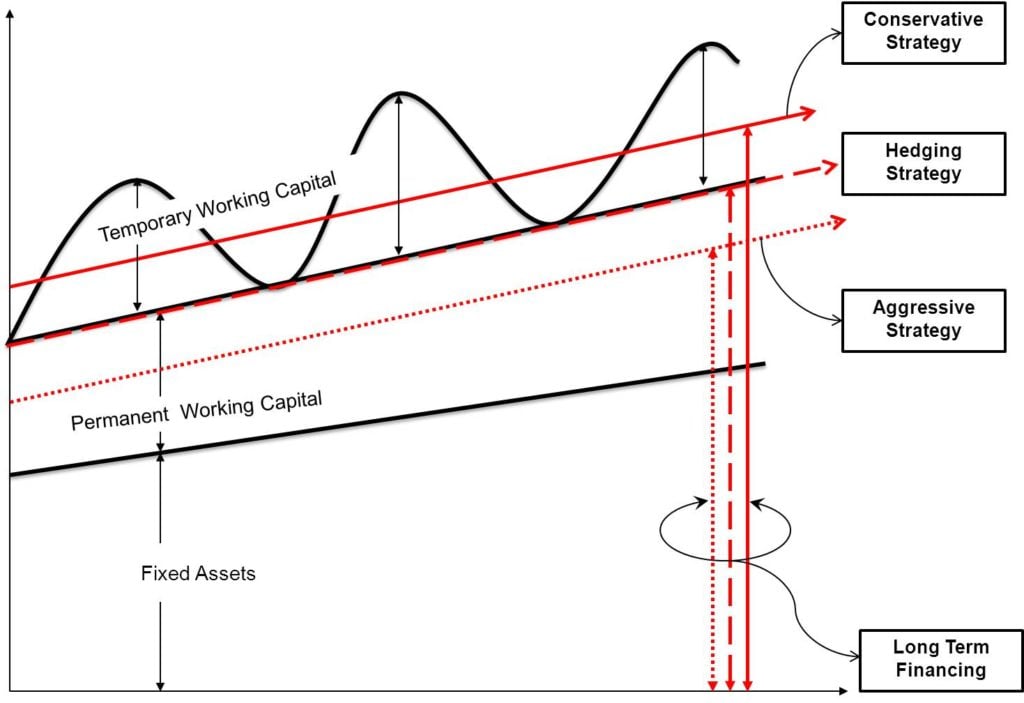

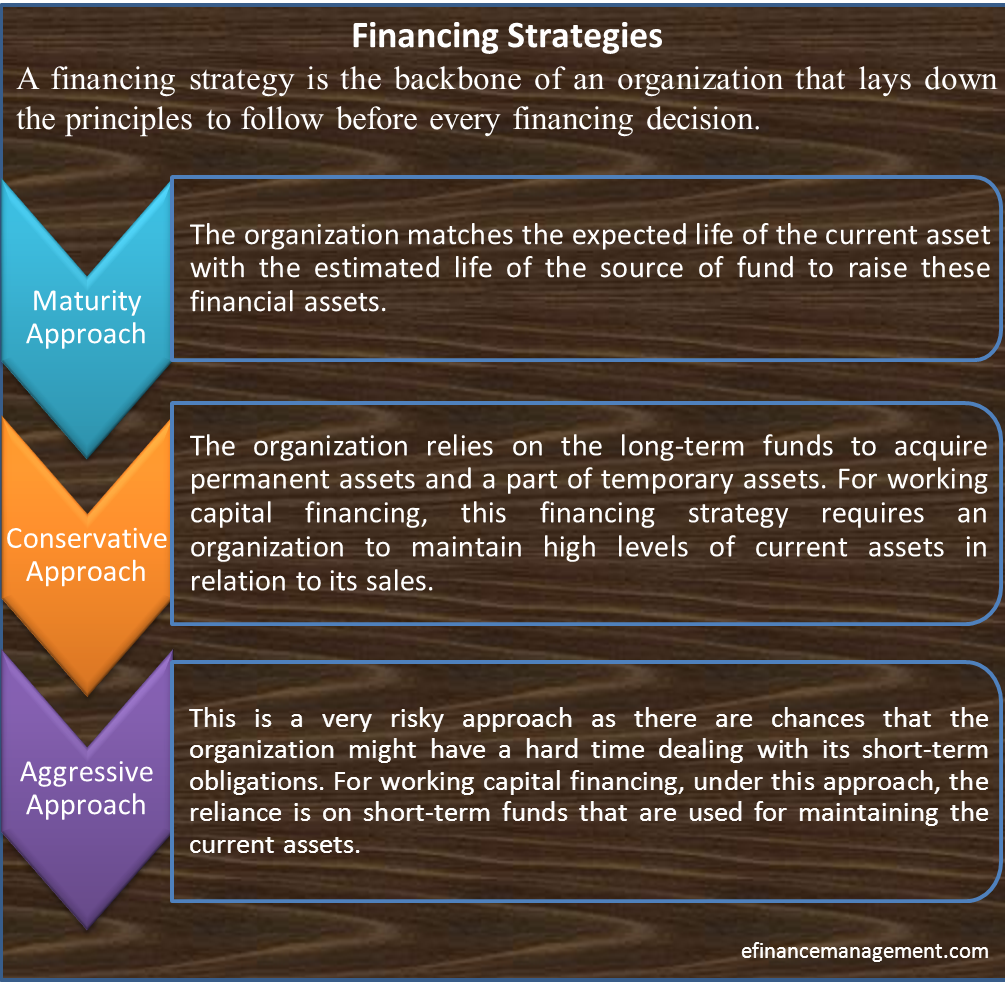

Working Capital Management Strategies Approaches

Importance Of Working Capital Management Accounting Education Financial Management Accounting And Finance

Financing Strategies Matching Conservative Aggressive Approach

Working Capital Cycle What Is It With Calculation

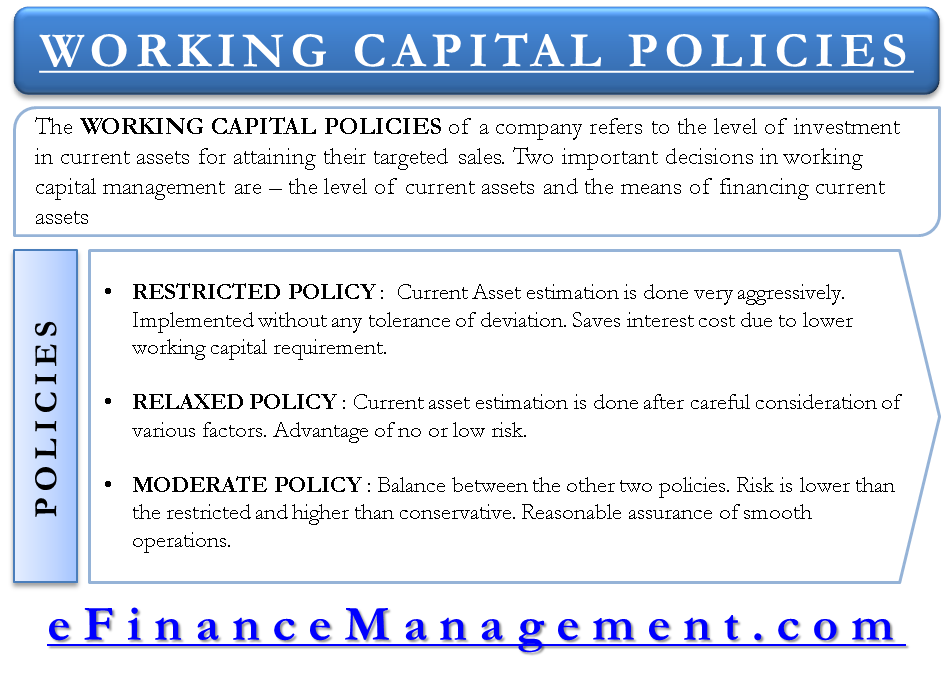

Working Capital Policy Relaxed Restricted And Moderate Learn Accounting Accounting And Finance Accounting Books

Financing Strategies Matching Conservative Aggressive Approach

Working Capital Management Conservative Approach Efm

Working Capital Policy Relaxed Restricted And Moderate

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations